Market Research Future Insights

According to MRFR analysis, the global Motorcycle Insurance Market Size is expected to register a CAGR of ~4.50% from 2022 to 2030 and hold a value of over USD 92.78 billion by 2030.

All forms of road vehicles, such as automobiles, trucks, motorbikes, and others, are covered by vehicle insurance coverage. When a car sustains damage or has body components hurt from accidents with other moving objects in heavy traffic or any other cause, the insurance covers the financial consequences for the vehicles. More than 40% of the overall non-life insurance premium goes toward motorbike insurance. In the next years, the market is projected to expand due to the increased demand for motorbike insurance in emerging nations. Due to the anticipated increase in new car sales, there are several nations throughout the world where auto insurance is required.

Get a Free Sample Report @ https://www.marketresearchfuture.com/sample_request/10016

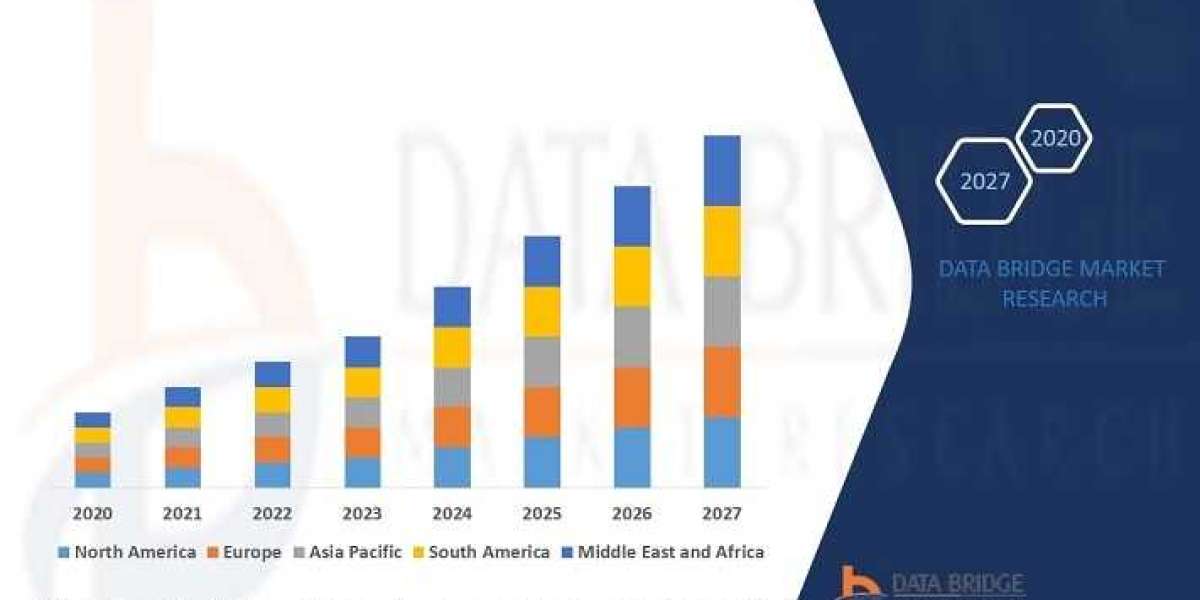

Regional Analysis

North America is predicted to occupy a significant amount of share the global Motorcycle Insurance Market Size shares. The growth in the creation of the vehicle sector in this area, along with the launch of new models by the major key players of the market in these regions. The government's law requiring insurance after purchasing a motorbike is projected to accelerate the expansion of the motorcycle insurance business.

Motorcycle Insurance Market Size Demand and Growth:

The demand for motorcycle insurance is expected to grow in the coming years due to the increasing popularity of motorcycles as a mode of transportation. This growth can be attributed to several factors such as the increasing number of riders, improvements in motorcycle technology, and an increasing focus on road safety.

In addition, the growing middle-class population and rising disposable incomes in developing countries are driving the growth of the motorcycle market, which in turn is boosting the demand for motorcycle insurance.

However, the growth of the Motorcycle Insurance Market Size may also be limited by several challenges such as high premiums, limited coverage options, and lack of awareness about the importance of insurance among riders.

Despite these challenges, the Motorcycle Insurance Market Size is expected to grow significantly in the coming years due to the increasing number of riders and the growing demand for insurance coverage. This growth will likely be driven by the increasing popularity of motorcycles as a mode of transportation, as well as by improvements in motorcycle technology and road safety measures.

Browse Full Report @ https://www.marketresearchfuture.com/reports/motorcycle-insurance-market-10016

Market Segmentation

The Global Motorcycle Insurance Market Size has been segmented into Policy Type and Application

Based on the Policy Type, the market has been segmented into Liability Insurance, Comprehensive and Collision Insurance, Medical Payments Insurance, and Others.

Based on the Application, the market has been segmented into Personal, Commercial.

Key Players

Some of the key market players are GEICO, Farmers Insurance, Allstate, Aviva, Allianz, AXA, CPIC, PingAn, Assicurazioni Generali, Cardinal Health, State Farm Insurance, Dai-ichi Mutual Life Insurance, Munich Re Group, Zurich Financial Services, and Prudential.

More Trending Report By MRFR

Electric Vehicle Battery Charger Market

Electronic Stability Control System Market